Over the past year, crypto acolytes have aimed to sell the world on an internet transformed by tokens and NFTs. All the while, a smaller subsection has pushed DAOs, or decentralized autonomous organizations, as a way to transform democracies and revamp stodgy organizations for an online age. Both groups have struggled with messaging and stateside legal guidelines, but the technical challenges for onboarding new users has been particularly strong for those looking to build their own DAO.

Syndicate, a DAO services startup which raised $20 million from Andreessen Horowitz last year, is looking to simplify the DAO creation process (as much as legally possible) with the launch of their new product called “Web3 Investment Clubs.” The tooling allows users to spin up a group of up to 99 participants, pool their capital and vote as a group on where to invest those funds.

Syndicate co-founder Ian Lee tells TechCrunch that the product offers users the ability to form a DAO with the “peace of mind to help maintain compliance and do the right thing for their their members.” The startup’s wider goal is to make forming these groups and investing in tokens and NFTs collectively as “easy as a group chat.”

The “investment club” branding is part of an effort to demystify DAOs for a broader group of users — in this case investors — and create an alternative path for users that may have been considering the formation of a similar investment vehicle using more traditional non-crypto financial services. The startup’s step-by-step guide to setting up a DAO showcases just how complicated the weave of services still can be for those less familiar with crypto best practices, but also how quickly one can form one of the groups if they can breeze through the technical onboarding.

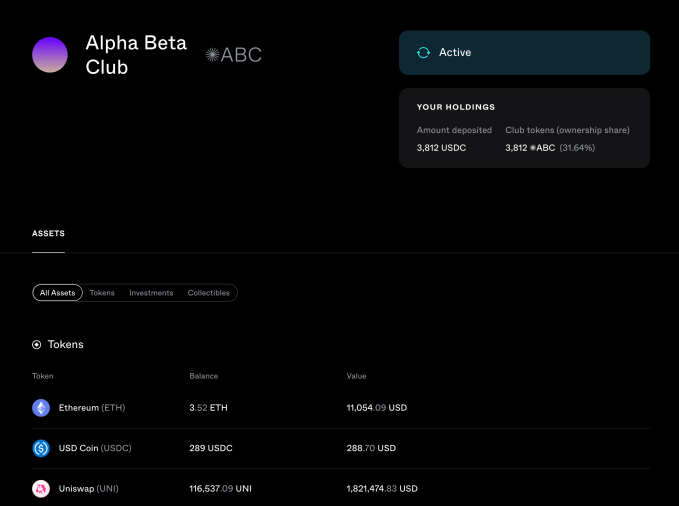

In addition to the setup guidelines, Syndicate offers a dashboard where users can peruse the holdings of their club and past activity.

Image via Syndicate

Syndicate is aiming to make these clubs flexible for users depending on their specific situations and tolerance for legal ambiguities. Certain guidelines exist for accredited and non-accredited users as well as DAOs that have members in the United States. The startup offers up basic guidelines that prospective club admins should be aware of — for clubs comprised of unaccredited investors in the U.S., every member most vote on every decision — but leaves the implementation up to end users. Syndicate’s suite of smart contracts can walk users through the process of formalizing their club with a legal entity and handling things like setting up a bank account and getting tax forms to ensure stuff stays above-board.

Syndicate is looking to position itself at the center of the DAO infrastructure ecosystem and get as many curious users familiar with their offerings. As such, this new service is free and Syndicate isn’t charging any fees for setup or maintenance.