Over the past decade, digital first banks like Chime, N26, NuBank, Monzo, and Revolut have come up. The ability to make deposits and manage accounts using a mobile app has been instantly appealing to millions of consumers. Collectively, these ‘NeoBanks’ are projected to have more than 145 million customers in North America + Europe by 2024.

This trend has only been accelerated by the COVID-19 pandemic. Since the beginning of the lockdown, there has been a ~72% increase in the use of fintech products and services.

Insurance on the other hand has been a laggard in technological transformation. It has long held the promise of an industry ripe for disruption. The industry size in the United States alone is massive (~$2 trillion in U.S. premiums in 2021) and nearly ~$6 trillion globally. The industry has been dominated by legacy market leaders and legacy processes and systems.

In 2019, StateFarm, the US market leader in property & casualty (P & C), accounted for more than $65 billion of premiums; MetLife, a global leader in life insurance, accounted for $95 billion. Each of them took in north of $5.5 billion in profit.

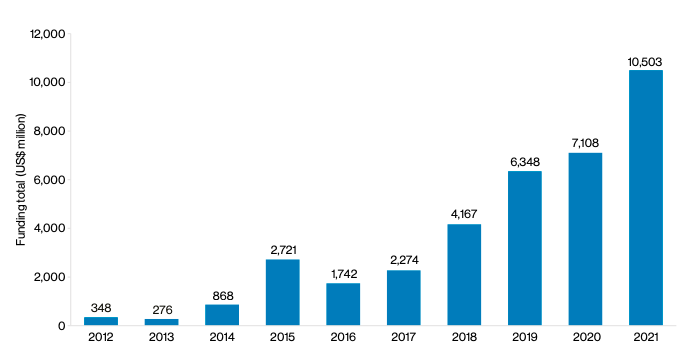

The private market is following suit. From 2014 to 2019, the total annual value of venture and PE deals in insurtech increased at a CAGR of almost 60%, with more than $6 billion of venture money invested in 2019 and again in 2020. Insurtechs raised ~$11–12 billion across ~450 deals in 2021. Insurance market leaders are noticing too. The likes of Allianz, Munich Re, Nationwide, Liberty Mutual, and others are pouring money into finding the next best thing in insurance.~50% of InsurTech financings in 2020 and 2021 included a strategic investor.

Insurance remains a painfully manual, paper-driven business. Pricing, underwriting, and settling claims is still primarily done using 20th century technology. But that’s a scenario ripe for change. The digitalization of insurance entails how policies are distributed, how claims are filed and resolved, how customers can be catered to in new ways that lower risk and increase engagement, and also how insurance risk is calculated and priced.

Insurance policies can be complex, and some policyholders may not understand all the fees and coverages included in a policy.

Let’s look here at the value chain of the traditional insurance process:

In legacy insurance systems, post the business development and “sale” of a policy, underwriting and closing may take several days, even several weeks. Once the policy is underwritten, claims management and customer service are cumbersome due to the insurer-centric and a paper-based structure. The commission structure of the status quo is such that agents and insurers make the process a misalignment of interest between the insurers and policyholders.

Insurance incumbents have dominated the market due to the competitive advantage of consumers’ trusted brand perception, an existing coverage network, regulatory compliance and licences, as well as being able to attract the most analytical actuarial talent. An insurance premium paid currently provides coverage for losses that might arise many years in the future. The financial stability and strength of an insurance company is a major consideration when buying an insurance contract for a consumer.

Profit in the insurance business can be reduced to a simple equation:

Insurer’s profit = sum of earned premiums and investment income on premiums after underwriting cost and claim expenses.

Startups are exploring the nexus of technology and insurance in an attempt to wake the dinosaurian industry. Insurtech startups have opened new streams of premiums, reimagined the distribution of insurance, encouraged investment income, found a leaner method to underwrite costs, or effectively managed claim expenses.

Insurtechs can be broken down into 3 broad categories:

Full Stack Insurtechs:

These are companies that offer insurance products either as a managing general agent (MGA), leasing a balance sheet from an insurance company for a set commission, or companies who underwrite insurance policies using their own balance sheet.

Some insurtechs start as MGAs and transition to writing their own policies and accepting the subsequent risk and reward. These companies address all parts (or at least the majority) of the insurance stack shown in figure 2. These full stacks also typically start in specific sectors of insurance (auto, commercial, life, cyber etc.) before expanding across insurance verticals.

This space has become increasingly saturated, and the differentiator for startups today is having unique acquisition strategies or a technological nuance to innovate on a part of the value chain (eg. underwriting / claims).

Some are betting on segments that are entirely new or have so far been badly served:

Insurance Aggregators & Marketplaces:

These companies serve as lead generation for traditional insurers and full stack insurtechs. Often, these companies aggregate policies across multiple providers and take a broker commission on each policy sold. Insurance distribution is perhaps the first area that adopted tech — taking insurance policies previously sold in person, online.

In developed markets, differentiation among aggregators has become hard, as growth stage insurtechs have mastered customer acquisition. However, this is still a massive area of opportunity in emerging markets where per capita insurance penetration is still low.

Enablers driving better automation and AI: The focus of this investment thesis

These companies, instead of offering a full-stack insurance product, address one or two components of the insurance value chain.

Normally, these ‘enabler’ companies sell directly to insurance companies or full-stack insurtechs and charge a software subscription fee or API fee.

After connecting with industry insiders, implementation experts, and fintech and insurtech investors, I uncovered the following key trends in automation in the insurance industry that startups can look toward.

Trend 1: Achieving even basic process automation is difficult given the complexity of legacy systems, employee reluctance & skill gaps, and security concerns

- Importance of retrofitting: Every insurance company wants to get off its legacy systems but it’s not easy, especially if a new vendor can’t retrofit

- Bridging the CIO and CTO gap: There is a disconnect in insurance with CTO and CIO and the business, usually the people in technology don’t know the business, the business people do not know technology

- Cybersecurity is top priority: Given amount of individual data, lack of robust cyber security ends up preventing risk-taking, adopting, and launching new products

Trend 2: Next-generation solutions should combine automation offerings with process mining and artificial intelligence to be dynamic and attractive for the industry

- Combining process mining, RPA and AI: Robotic process automation builds a process based on what humans do, but process mining is really the critical step, using robots to figure out what humans actually do. Solutions combining process mining + RPA + AI is the next step in automation.

- AI for more complex use cases: Using AI to tackle more complex issues in insurance — like AI in legal.

Trend 3: Selection Overload is Shaping Go to Market Strategy

There are ~10,000 insurance carriers in the US, even if 10% buy your product, it’s still a huge market. Traditional insurers and large insurtechs are being approached by hundreds of vendors and startups.

- Domain expertise: In a saturated market, to be successful, startups need to find an angle to go into the market against the grain of large cloud providers, and this is where domaine expertise paves the right to win

- Go to market strategy is key: The best go to market strategy is channel partners and the internal sales team. Go directly to the person in the target company who will get most out of what you’re doing. Carrier partnerships can take so long that you can’t use it as your initial go to market strategy.

Trend 4: Underwriting is a new frontier

From an insurance carrier perspective, the evolution of insurtech is easy to understand. First, policy distribution was ripe for disruption (the initial era of Lemonade, Ladder), then Claims was the next process to make more efficient (eg. ClaimsX).

Underwriting and the actuarial team make a lot of money for the organization, however much of their work is still done in spreadsheets. Claims is high cost, but underwriting is what an insurance carrier believes their secret sauce and competitive advantage is. Automating Underwriting requires cognitive automation, not just RPA.